Roof Depreciation Life Rental Property

However there is an aspect of the appraisal fee that could be considered an ordinary and necessary expense of doing business in this case.

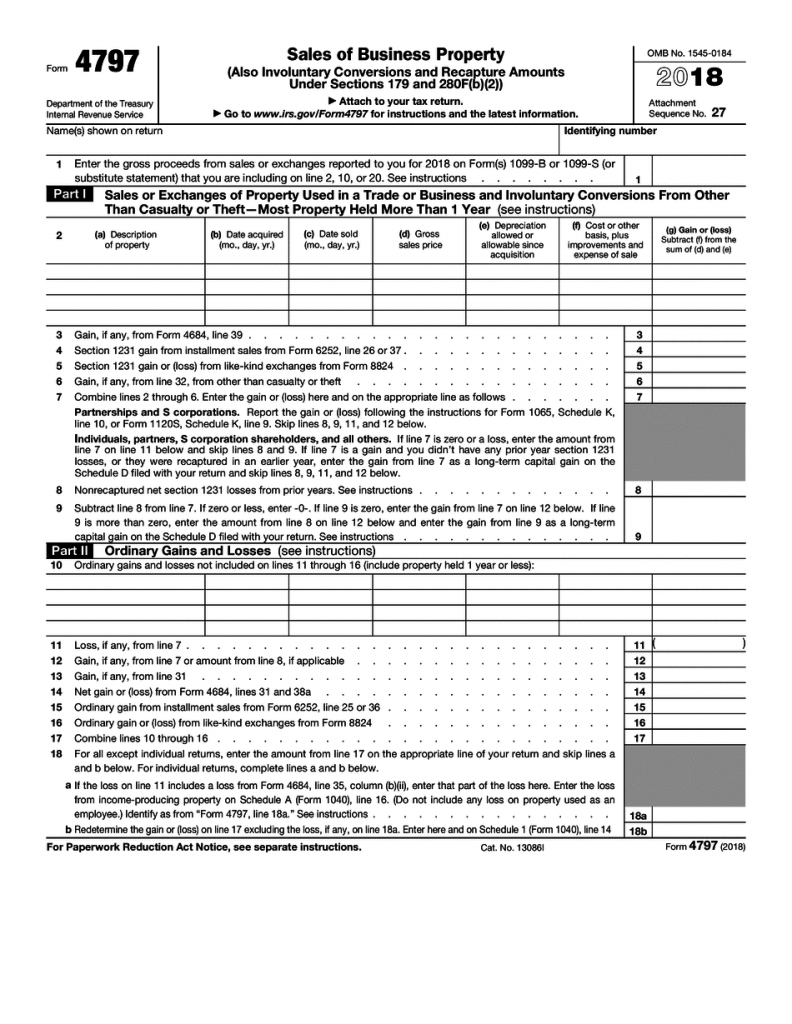

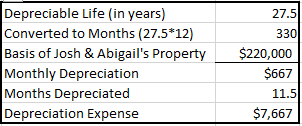

Roof depreciation life rental property. Depreciation starts when you bring the new roof into service. When compared to the alternative option of depreciating the cost over a 27 5 year life for residential rental real estate or a 39 year life for commercial real estate under the modified accelerated cost recovery system an incorrect conclusion may lead to a significant overpayment of tax liability. Correct normally these are either added to the basis or amortized over the life of a loan. The deduction to recover the cost of your rental property depreciation is taken over a prescribed number of years and is discussed in chapter 2 depreciation of rental property.

Generally each year you will report all income and deduct all out of pocket expenses in full. These are the useful lives that the irs deems for both types of properties. Rental property depreciation is calculated over 27 5 years for residential property and 39 years for commercial property. Are generally depreciated over a recovery period of 27 5 years using the straight line method of depreciation and a mid month convention as residential rental property.

Depreciation ends after 27 5 years when you have fully recovered the cost of the new roof. If the property is unoccupied you bring the roof into service when you next lease the rental property. Can i use a special depreciation allowance for a new roof for a rental property.